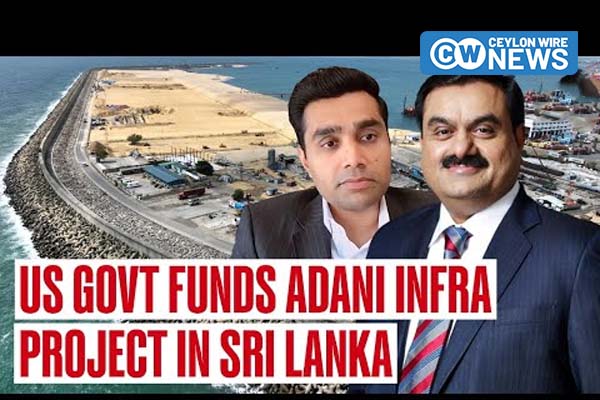

Embattled billionaire Gautam Adani pulled out of a loan deal with an American agency to fund a port terminal in Sri Lanka’s capital, ending an agreement hailed a year ago as an effort by India and the US to counter China’s growing influence in the region.

An entity majority-owned by Adani, who was indicted in US courts last month, said in a company filing on Tuesday that it was exiting talks on a loan valued at $553 million from the US International Development Finance Corporation. After the bribery allegations came to light last month, the US agency said it was still conducting due diligence and hadn’t reached a final agreement on the loan.

“The project will be financed through the company’s internal accruals and capital management plan,” the filing said, referencing the financing deal for a port terminal in Colombo being developed by Adani Ports and Special Economic Zone Ltd. “We have withdrawn our request for financing from the DFC.”

The statement made no mention of the indictment of Adani, Asia’s second-richest man, and other executives of his Adani Group. They were indicted in US courts on charges last month that they paid or promised to pay more than $250 million in bribes to Indian government officials to win solar energy contracts, and concealed the plan as they sought to raise money from US investors. The company has denied the US allegations.

The loan agreement for the terminal in Sri Lanka was signed last year amid US enthusiasm to offer an alternative to China for infrastructure investment in the developing world. Initially scheduled to be operational by December 2024, the deepwater West Container Terminal in Colombo was set to be the US government agency’s largest infrastructure investment in Asia, and among its biggest globally.

“It is a high priority for the US to be active in the Indo-Pacific region,” Scott Nathan, the DFC’s chief executive officer, told reporters in Colombo in November 2023. “It is obviously the engine of economic growth for the world.”

He was joined at the time by Karan Adani, the tycoon’s son and chief executive officer at Adani Ports, who said the deal was “reaffirmation by the international community of our vision, our capabilities and our governance.” At the time, the Adani Group had been fighting a raft of corporate fraud allegations leveled by short seller Hindenburg Research and various media investigations, which it had repeatedly denied.

Yet the US and Adani failed to seal the deal in the ensuing months, and no American financing had been disbursed before the announcement that talks on the loan were ending.

Despite the US indictment, the Adani Group has sought to show that it’s conducting business as usual. Its billionaire founder sat close to Indian Prime Minister Narendra Modi at a public conference, where the group pledged tens of billions of dollars in fresh domestic investment.

Adani’s sprawling empire, which runs from construction projects to media properties, has been under fire since the Department of Justice’s announcement, with Kenya canceling $2.6 billion worth of airport and power transmission contracts the tycoon’s conglomerate had pitched for in the hours after the ruling.

Colombo’s port is one of the busiest in the Indian Ocean, given its proximity to the international shipping routes.

(Bloomberg)